Estate planning is a crucial aspect of financial and legal management that often gets overlooked or postponed. Many individuals assume that estate planning is only for the elderly or the wealthy, but the truth is that everyone can benefit from proper estate planning. In this blog post, we will delve into the significance of estate planning and shed light on real-life examples where neglecting or poorly executing an estate plan has led to undesirable outcomes.

Safeguarding Your Loved Ones: One of the primary reasons estate planning is important is to ensure the well-being of your loved ones. When someone passes away without a will or a comprehensive estate plan, it can lead to conflicts and disputes among family members. Without clear instructions on asset distribution and guardianship for minor children, the court may intervene and make decisions that may not align with your wishes.

A Case of Family Discord: Imagine a scenario where an individual passed away suddenly, leaving behind significant assets and a blended family with multiple minor children from each relationship. Since there was no estate plan in place, the deceased’s biological children and the surviving spouse from the second marriage engaged in a lengthy legal battle over the distribution of assets. The first marriage’s minor children are now co-owners of the estate with the deceased’s surviving spouse pitting them against each other. This is unnecessary and could have been prevented with an estate plan that addressed the specific dynamics of the family and clearly outlined the individual’s intentions.

Ensuring Business Continuity: For business owners, estate planning is vital to ensure a smooth transition and the continuity of operations in the event of incapacity or death. Without a proper plan in place, the future of the business may be uncertain, leading to potential conflicts, financial instability, and even the collapse of the business itself.

The Fall of a Family Business: Imagine a family business that had been thriving for generations suddenly coming to a standstill when the founder unexpectedly passed away. Due to the absence of a succession plan, disagreements arose among family members regarding leadership and asset distribution. The lack of clarity and direction resulted in a decline in business operations and delays in probate court, leading to financial losses and a tarnished family legacy. A well-crafted estate plan, including a succession plan, could have avoided this devastating outcome.

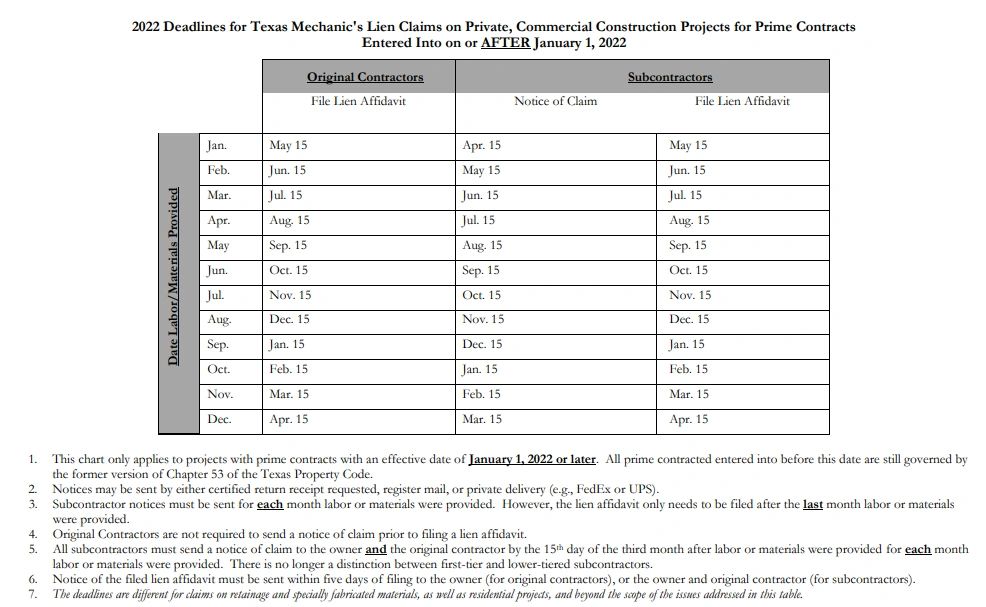

Minimizing Estate Taxes: Estate planning allows you to minimize the impact of taxes on your estate, thereby preserving a larger portion of your assets for future generations. By utilizing various strategies and tools like trusts and gifting, you can strategically plan your estate to take advantage of tax exemptions and deductions.

The High Cost of Poor Tax Planning: Consider a case where an individual with a substantial estate neglected to engage in proper estate planning. As a result, their beneficiaries were burdened with exorbitant estate taxes, significantly reducing the wealth that could have been passed on to the next generation. With careful estate planning, this individual could have explored tax-efficient strategies, potentially saving their heirs a significant financial burden.

Conclusion: Estate planning is not a task to be delayed or dismissed lightly. The real-life examples discussed above demonstrate the repercussions of neglecting or poorly executing an estate plan. By taking the time to engage in estate planning, you can safeguard your loved ones, minimize estate taxes, and ensure the smooth transfer of your assets. Consulting with an experienced estate planning attorney will enable you to create a tailored plan that reflects your unique circumstances and protects your legacy. Remember, estate planning is not just for the wealthy—it is for anyone who wishes to have control over their assets and provide for their loved ones in the most efficient and effective way possible.

Book a consultation to protect your loved ones after you are gone.